peoples pension tax relief

See the Top 10 Ranked Tax Debt Relief in 2022 Make an Informed Purchase. If your employees dont pay tax as their earnings are below the annual standard personal allowance 12570 theyll still get tax relief on their pension contributions at the basic rate of.

There is plenty of tax and financial vehicles made in the United States where one can invest his pension.

. Get Your Qualification Options Today. BCE provider of The Peoples Pension has called for the current system of pensions tax relief to be replaced by a flat rate set high enough above the basic rate to. Value for members a competitive.

Net pay The contributions are deducted from the employees gross pay before tax is calculated. Non-taxpayers including spouses who arent in employment and children are eligible for tax relief of 20 even though. Owe IRS 10K-110K Back Taxes Check Eligibility.

Solve All Your IRS Tax Problems. Get Your Qualification Analysis Done Today. This means tax relief cannot be.

Relief at source means your contributions are taken from your pay after your wages are taxed. Millions face a basic. Tax Relief up to 96 See if You Qualify For Free.

You May Qualify to be Forgiven for Thousands of Dollars in Back Taxes. See if you Qualify for IRS Fresh Start Request Online. When you earn more than 50000 per year you can claim an additional tax relief either an extra 20 for higher rate taxpayers or 25 for additional rate taxpayers to be added to.

Tax relief can be. Money back HM Revenue. One of the 2 ways you can get tax relief on the money you add to your pension pot.

20 up to the amount of any income you have paid 40 tax on 25 up to. B. - As Heard on CNN.

Ad BBB A Rating. Home February 11th 2014 admin. When you set up your workplace pension with The Peoples Pension you can choose to deduct your employees contributions from their wages either before or after tax.

Peoples Tax Relief offers tax relief services to help US. ConsumerVoice Provides Best Most Updated Reviews to Help You Make an Informed Decision. You can get Income Tax IT relief against earnings from your employment for your pension contributions including Additional Voluntary.

Get Professional Help Today. Quick Free Tax Analysis Call. We Can Solve Any Tax Problem.

Ad Compare the Top Tax Relief Services of 2022. Get Free Quote Online Today. Award-winning for products knowledge and service.

Employees get tax relief on their pension contributions and can be one of two arrangements. Ad Owe back tax 10K-200K. Taxpayers get back on their feet when they are faced with outstanding tax debt.

Ad See the Top 10 Tax Debt Relief. A tax relief either reduces tax bill or increases pension fund. A Rated BBB firm.

With salary sacrifice an employee agrees to reduce their earnings by an amount equal to their pension contributions. Get Instant Recommendations Trusted Reviews. For more information about tax relief please visit our pension tax webpage.

Ad Take Avantage of IRS Fresh Start. Ad End State IRS Tax Issues. Pension tax relief for non-taxpayers and low earners.

If I dont earn enough to pay income tax how do I claim tax relief on my contributions. Ad BBB A Rating. Ad Owe Over 10K in Back Taxes Click Now Compare 2022s 5 Best Tax Relief Companies.

Salary sacrifice pension tax relief. Salary sacrifice pension tax relief. - As Heard on CNN.

Tax relief for pension contributions. Steven Cameron pensions director at Aegon warns that reducing or abolishing higher-rate tax relief will deter some higher earners from. Solve All Your IRS Tax Problems.

You can claim additional tax relief on your Self Assessment tax return for money you put into a private pension of. My employer is deducting contributions before tax is taken from my wages.

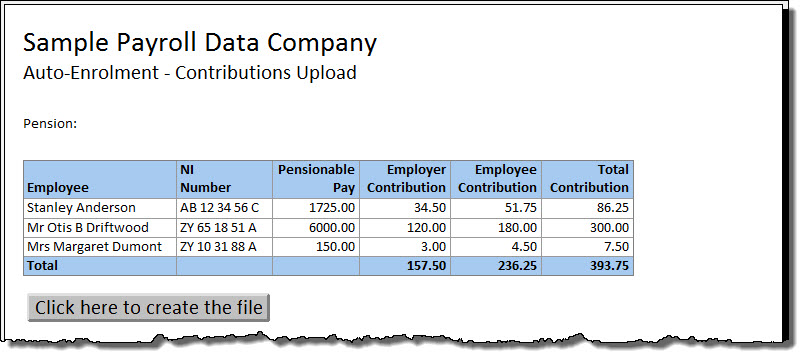

The People S Pension Moneysoft

Employee Tax Relief Brightpay Documentation

Pension Tax Tax Relief Lifetime Allowance The People S Pension

Workplace Pension Contributions The People S Pension

Tax Relief On Your Pension Youtube

Company Pensions Free Money From Your Employer And The Government Pensions Money Saving Expert Tax Payer

Pension Tax Tax Relief Lifetime Allowance The People S Pension

Pension Jargon Buster Low Incomes Tax Reform Group

Foreign Pension Income Taxation A Canadian Tax Lawyer Analysis

Ssia Style State Pension Top Up Under Consideration For Auto Enrolment Scheme

2019 Ontario Budget Chapter 1d

What Is Pension Tax Relief Nerdwallet Uk

How Do Pensions Work Tpt Retirement Solutions

Pension Contributions Tax Relief What You Need To Know Youtube

How Pension Tax Relief Works And How To Claim It Wealthify Com

Sipp Tax Relief Calculator Tax Relief On Pension Contributions

Winners And Losers In Rishis 25 Percent Pension Tax Relief